Star Wars Game Sales Plummet: Analyst Predicts Decline

Ubisoft's Star Wars Outlaws Underperforms, Impacting Share Price

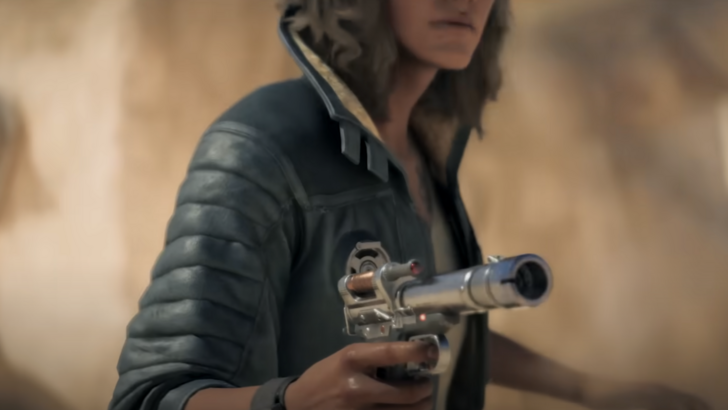

Ubisoft's highly anticipated Star Wars Outlaws, intended as a financial turnaround point, has reportedly underperformed in sales, causing a dip in the company's share price. Despite positive critical reception, sales have been described as sluggish.

Stock Decline Follows Launch

The game's release on August 30th was followed by consecutive days of share price decline. On September 3rd, Ubisoft's stock fell 5.1%, further dropping 2.4% by Tuesday morning. This marks the lowest point since 2015, adding to a year-to-date drop exceeding 30%.

Analyst Downgrades Sales Projections

J.P. Morgan analyst Daniel Kerven revised his sales forecast for Star Wars Outlaws downward from 7.5 million units to 5.5 million units by March 2025, citing the game's failure to meet expectations despite positive reviews.

Ubisoft's Q1 2024-25 report emphasized the importance of Star Wars Outlaws and Assassin's Creed Shadows as long-term value drivers for the company's financial recovery. While the report noted a 15% increase in console and PC session days, largely due to Games-as-a-Service, and a 7% year-on-year rise in monthly active users (MAUs) to 38 million, the underwhelming performance of Star Wars Outlaws casts a shadow on these positive metrics.

Mixed Player Reception

The discrepancy between critical acclaim and player reception is notable. While critics generally praised the game, user reviews on Metacritic average a mere 4.5 out of 10, contrasting sharply with Game8's 90/100 rating. For a more detailed perspective, see our full review (link omitted). The contrasting reviews highlight a potential disconnect between critical expectations and player experience.

-

New details have emerged about the long-rumored remake of The Elder Scrolls IV: Oblivion, with leaked screenshots and images showcasing significant visual upgrades in The Elder Scrolls IV: Oblivion Remastered. Leaked Images Surface From DeveloAuthor : Hannah Nov 26,2025

-

Renowned director Joe Dante, celebrated for classics like Gremlins and its sequel, also helmed the 1998 cult favorite Small Soldiers. This nostalgic gem is now receiving a premium 4K upgrade with an exclusive steelbook edition. For collectors seekingAuthor : Sebastian Nov 25,2025

- WWE Superstars Join Call of Duty Warzone: Mobile Roster

- Monster Hunter Now Adds New Monsters for 2025 Spring Fest

- Midnight Girl is a minimalist point-and-click adventure set in Paris in the 60s, now open for pre-orders on mobile

- "Grand Outlaws Unleashes Chaos and Crime on Android Soft Launch"

- Mobile Legends: Bang Bang – Best Lukas Build

- "Fallout Season 2 Premieres in December 2025, Season 3 Confirmed"