App Features:

-

AI-Powered Deduction Tracking: Automatically discovers all eligible tax deductions, including car mileage, home office expenses, and business meals, minimizing your tax burden.

-

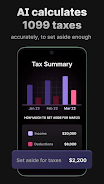

Tax Payment Planning: Tracks income, expenses, and deductions to help you determine the optimal monthly tax savings.

-

Free Resources & Calculators: Access valuable tools such as a 1099 tax calculator, quarterly tax calculator, free CPA webinars, and comprehensive tax guides for stress-free tax preparation.

-

Automated Bookkeeping: Automate your finances, simplifying expense tracking and reducing your tax filing workload by 95%.

-

CPA-Prepared Tax Filings (Federal & State 1099): Our experienced CPAs meticulously review, prepare, and file your tax returns, maximizing your refund and providing complete audit protection.

-

Unlimited CPA Support: Benefit from unlimited access to our expert CPAs with over 100 years of collective experience, providing answers to all your tax questions.

In Conclusion:

FlyFin is the ultimate tax solution for freelancers and the self-employed. Its sophisticated AI technology, coupled with expert CPA support, guarantees accurate tax filing and maximum tax savings. The app's intuitive tools and automated features simplify financial management, providing peace of mind and control over your finances. Download FlyFin now and experience the future of tax preparation! We prioritize data privacy and utilize state-of-the-art security measures to protect your information.

Download

Download