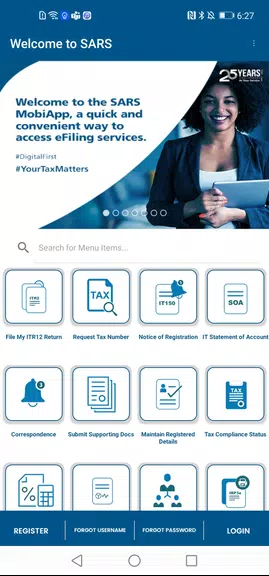

The SARS Mobile eFiling App

The SARS Mobile eFiling revolution simplifies tax submission for South Africans, offering a streamlined platform to complete and file Income Tax Returns from anywhere. This cutting-edge application enables taxpayers to access annual returns, save drafts locally, utilize tax calculation features to predict outcomes, and monitor submission statuses effortlessly. Combining simplicity with robust security, the app empowers users to manage tax obligations with unprecedented flexibility.

Key Benefits:

- Seamless Convenience: Submit annual Income Tax Returns directly from smartphones or tablets via an intuitive interface designed for mobile efficiency.

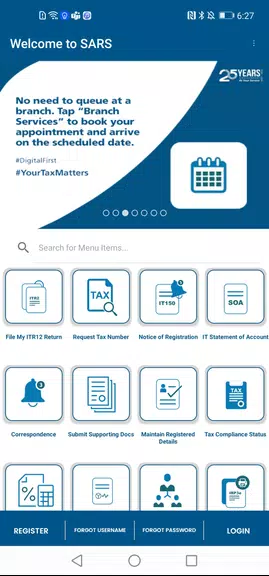

- Complete Mobility: Manage tax affairs whenever and wherever needed - no longer constrained by office hours or computer access.

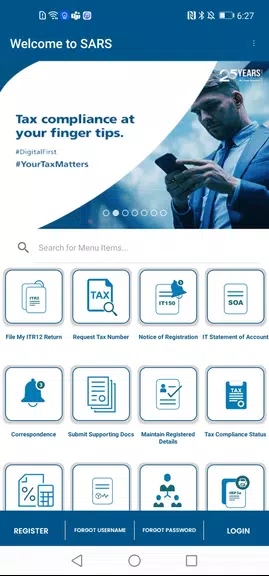

- Bank-Grade Security: Enjoy encrypted submissions and enterprise-level data protection eliminating common tax filing anxieties.

- Smart Estimation Tools: Leverage built-in calculation features to forecast tax obligations and plan finances accordingly.

Common Questions Answered:

- Data Protection: Does SARS Mobile eFiling safeguard sensitive information? Yes - all transmissions use military-grade encryption protocols.

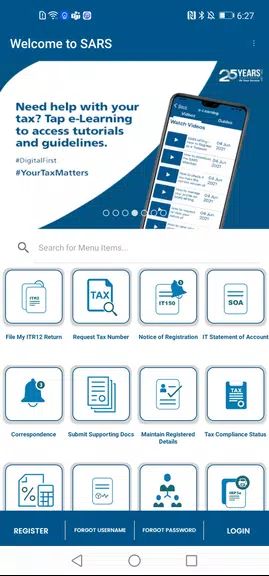

- Historical Records: Can previous tax documentation be accessed? Absolutely - view ITA34 assessments and ITSA statements dating back several years.

- Business Functionality: Does this support corporate tax filings? Currently optimized solely for individual taxpayer needs.

Final Recommendation:

As South Africa's premier mobile tax solution, SARS Mobile eFiling transforms mandatory obligations into manageable tasks through technological innovation. Whether you're a tax veteran or first-time filer, this application delivers professional-grade functionality in your pocket. Install today to experience next-generation tax administration convenience.

Download

Download